Let’s face it, buying a car from a car dealership can be stressful sometimes. From dealing with a pushy car salesman to sweating it through the financing approval process, the excitement is sucked out of the entire experience in many cases.

Due to the stressful nature of some car dealerships, many are gravitating to buy here pay here dealerships as their source of purchasing a vehicle.

While most are vaguely familiar with bad credit car dealers, all too many are misled or not well informed as to the opportunities this type of in-house financing presents to those looking for an automobile, especially those who are uncertain of the quality of their credit score.

The following is a complete guide to buy here pay here, including what it is, how it works and how much you can expect to pay at a dealer that offers this financing option.

Also commonly referred to as "in-house financing", "buy here pay here" is a form of automobile dealership in which the loan for a vehicle is provided and serviced by the dealer themselves.

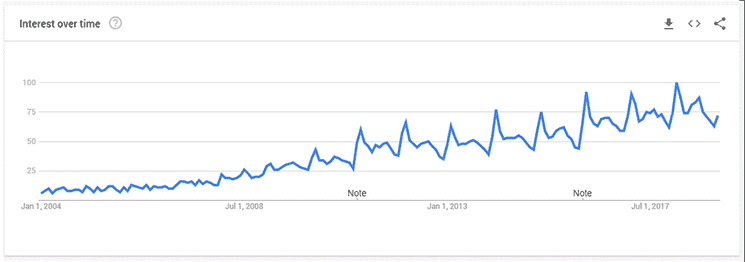

In fact, this type of dealership financing has gained popularity in the past fifteen years. As shown below, the interest in buy here pay here as a form of car buying has steadily increased, and the trend is likely to continue moving forward.

The biggest difference between a buy here pay here dealership and a more traditional one is that with buy here pay here, almost everything goes through the local car dealer directly. This means the monthly payments are made directly to the dealership, and the financial contract that is agreed upon for the vehicle is between the dealership and the buyer only, rather than a bank or other lender.

The most glaring difference between a traditional dealership and a buy here pay here place is the way financing is handled. In an auto sale at a traditional car dealership, the credit is provided by a bank or other form of outside institution.

Since the loan is provided by the dealer, they are often much more flexible in the approval process, allowing those with lower credit scores to be able to get a quality vehicle without being turned down or required to pay the entire price for the vehicle upfront.

Since buy here pay here dealers often deal with higher risk car buyers, the interest rates and penalties for missed payments may be more strict than with a traditional car dealership.

This type of car lot can easily be found in almost every city in the United States. Anyone who has ever looked out of the window while riding down a highway has likely seen this kind of used car lot.

For the most part, a BHPH dealer looks very similar to a traditional car lot. In many cases, these lots have a sign on or near their place of business, showcasing their BHPH offerings or, more subtly, state that they finance, or do in-house financing. In other words, a car dealership with a “buy here pay here” or “we finance” or "no credit check" sign is likely a buy here pay here car lot.

You can find these car lots through a quick online search. An easy way to find one nearby is to search for "buy here pay here near me" and it will show you the dealers that are closest to you. Or you can do it the old-fashioned way and drive around your city looking for auto dealerships that offer in-house financing.

Since these dealerships often deal with car buyers that have few other options for financing, many have a misconception that all buy here pay here car lots are scams.

However, most of these lots are usually honest and upfront about what to expect when paying for the vehicle.

Since they are often taking on huge risk on their end, they may have a more strict pay policy and higher interest rate than many traditional dealerships, but most dealerships can be trusted to be honest and follow the rules set forth in the contract provided.

Be sure to actually read the contract closely and ask the necessary questions before signing, and you should be able to ensure you are not subject to a bad, misleading deal. Of course, the same principles apply whenever you make a major purchase like a vehicle.

In most areas BHPH car lots work the same way as traditional dealerships. From the process of selecting the car you want from the dealership’s inventory to placing a down payment and making monthly payments, the process is pretty traditional.

After finding a local BHPH dealership you think has a good selection of vehicles and a trusted reputation, go to the dealership and the salespeople can help you with the pre-approval process and give you the chance to take a test drive or two and answer your questions.

While this kind of dealer is less likely to turn you down if you have a steady income and a large enough down payment, there are other factors like work history and time in the area that will influence your monthly payment and interest rate.

At a traditional dealership, you are likely to need an extensive list of documents, including bank information and proof of residency.

WIth buy here pay here, there is not much that is required on the day of purchase. In most cases, the following is all that is required:

In most cases, proof of residency may be required. However, buy here pay here dealerships are much more likely to work around missing documents than a traditional dealership.

One of the main reason buy here pay here skeptics have negative feelings toward this kind of dealership is because of the crazy stories people hear about what happens if a payment is missed.

While there are buy here pay here dealerships that repossess vehicles if the payment is a minute late - or possibly even have a GPS and a kill-switch installed to keep the car from working if a payment is missed - most dealerships are more lenient.

Be sure to discuss the policy on missed payments before purchasing a vehicle from any car dealer

Most buy here pay here places are not as heartless as they are perceived. However, consistently missing payments almost always leads to the car being repossessed and a huge hit to your credit score at a minimum.

The cost of buy here pay here cars can be somewhat tricky to calculate. While the list price is typically similar, if not cheaper, than what can be expected at a traditional auto dealership, the final price after interest is dependent on various factors and can in many cases be more expensive than what one might pay for the same vehicle at a traditional auto dealership.

There are various factors that typically determine the final price of a vehicle, including the buyer’s credit history, down payment amount and length of their contract. For someone looking to pay the total amount in cash upfront for the vehicle, buy here pay here is an amazing way to find a great deal.

For long-term contracts, however, it is important to negotiate interest rates and find the best deal possible to avoid paying more than necessary for a car or truck.

Of course, you can also save a lot of money on interest costs if you prepay any all of your loan. Just an extra payment here or there can save a significant sum.

The average interest rate is often exaggerated. Many who are hesitant to purchase from a buy here pay here dealership are concerned with the fear of having to pay crazy interest rates.

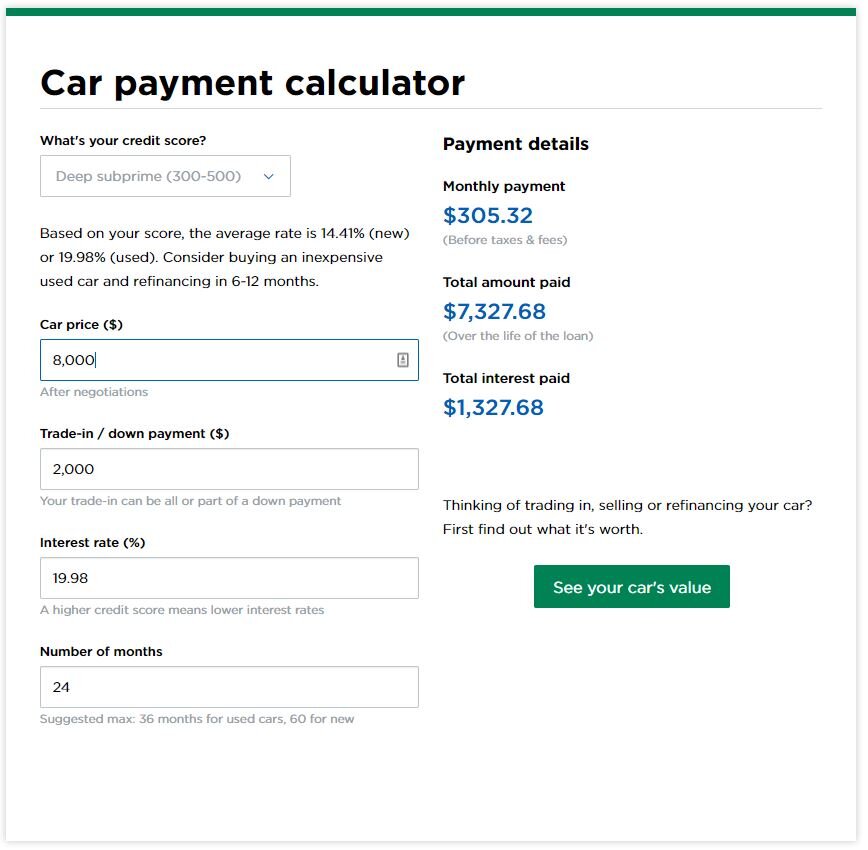

While some of these dealerships may charge the highest interest rate possible, the average interest rate at a buy here pay here car lot tends to land between 15 percent and 19 percent.

That said, there are a number of considerations that factor into the interest rate, perhaps none more so than the buyer’s credit score. For those with low credit scores, an interest rate around 20 percent is actually quite reasonable. But this is true no matter what you're financing - whether it's a car, a house, or even a credit card.

Another major fear of many BHPH skeptics is that they may be sued if they are unable or fail to make a payment.

The short answer is yes, it is possible for a buy here pay here dealership to sue the buyer, especially if the car is not able to be resold for the amount established in the contract - as they can then sue for deficiency. In this case, the dealer is also the lender and the failure to make the necessary payments likely means the contract was not satisfied in its entirety.

In the event a buy here pay here lot sues, they may be able to garnish wages (see below). However, it is rather rare for the dealer to sue. In most cases, the failure to make payments results in repossession and a critical hit to the buyer’s credit.

In the event a bad credit car dealership decides to sue the car buyer for deficiency when the contract is not satisfied, and if the dealer wins the lawsuit, they will then have the right to garnish wages. In more severe instances, they may be able to garnish up to 25 percent of your wages.

However, most dealerships choose not to sue in the event a buyer is unable to continue payments, which means they relinquish their right to garnish wages.

The best way to ensure a used car dealer does not decide to sue - and therefore is unable to garnish your wages - is to make all of the necessary payments without being late. In the event you do everything possible to make the payment happen and are still unable to, be sure to let them know as soon as possible as communication could be the key to avoiding a lawsuit.

Yes, any time you miss auto loan installment payments, it should go on your credit. However, the answer to whether or not the same is true for buy here pay here car lots is more complicated than a simple yes or no answer.

The fact of the matter

Ideally, you should want your used car loan to go on your credit. Be sure to discuss the process of reporting to the credit bureaus with your car dealer.

By choosing a trustworthy no credit check dealership that has a history of consistently reporting to the credit bureaus, you can ensure your payment is reported and your credit score will rise if your payments are timely.

Anytime you take out a used car loan with a lender and they report the routine payments to the credit bureau, then you have the chance to help your credit. Therefore, bad credit auto loans should indeed help your credit if the payments are made in a timely manner.

However, whether or not buy here pay here helps your credit depends on several different factors. First and foremost, you must stay up-to-date on all payments throughout the entirety of the contract when attempting to raise your credit score through auto financing

Secondly, be sure to confirm that the dealership is reporting the payments to the credit bureau. Otherwise, all of your hard work and consistency with payments may not affect your credit score at all. In some cases, the dealer will sell your note to a third-party lender, which will then report your payments.

Any kind of auto financing can build credit, assuming all of the payments are made on time, the contract is fulfilled entirely and the lender - the buy here pay here dealership in this case - reports the payments to the credit bureau.

However, bad credit car loans can have the opposite effect on your credit score as well if the payments are made late and the contract is not fulfilled, which can lead to the repossession of the vehicle. When payments are made late with a bad credit car dealership, you can see your credit score really take a hit and it will make it difficult to get another car in the future.

Subsequently, it is very important to stay on track with all of the scheduled payments and communicate well with the dealership if a payment is going to be made late.

Buy here pay here car dealerships most often report to credit bureaus, although they are not obligated to do so. In some cases, these bad credit car dealers may not report to credit bureaus, which means paying on time does not help your credit score. Each lot has different policies about reporting, so if that's important to you, be sure to ask up-front.

When attempting to raise your credit score through in-house financing, it is very important to ask and ensure that the buy here pay here car lot is reporting your routine payments to the credit bureau.

By ensuring your payments get reported properly, you can begin to raise your credit score, which means more vehicle and financing options will be available to you the next time you're in the market for another vehicle.

Unfortunately, as a consumer, you cannot directly report payments to a credit bureau, and the reports need to come from your local used car dealer directly.

Because of this, it is important to ensure the buy here pay here dealership reports the loan and meets all of the necessary requirements at the start of the contract. It is also important to ensure they are reporting the payments each time. Otherwise, the payments may not be reported and your credit score will not rise as a result.

There are three main credit bureaus that buy here pay here places are able to report to, which are Equifax, Experian and TransUnion.

By ensuring the payments are reported to the credit bureau, you can raise your credit score with timely payments.

In some cases it is possible to return a car to a no credit check dealer, but doing so will make it get reported as a repossession and will subsequently affect your credit in a negative manner.

However, every instance of a car being returned is unique, and the exact requirements and details will only be found in the contract established by the dealership and the buyer.

In a worst-case scenario for the car buyer, the car may not be able to be returned at all and a lawsuit is filed for deficiency, which occurs when the dealership is unable to resell the vehicle for the amount left on the contract.

Each buy here pay here is different, however, and it is important to establish good communication with the dealership to avoid any tricky return situations.

There are essentially three ways to remove yourself from your vehicle loan, which is to either return the car, trade it in, or sell it yourself.

It is best to avoid returning a vehicle to a dealer as doing so can have some severe consequences, including a drop in your credit score, getting sued and even the garnishment of your wages. Even if you bring the car to the dealership before the contract has ended, it still is reported as a repossession.

Can you trade in a buy here pay here car? Of course. You can always trade it in for a newer vehicle. This is most ideal if the value of the car is greater than what is owed. In the event it is not, the difference in value between what the vehicle is worth and what is owed is added onto the loan amount for the new vehicle.

It is always best to try to fulfill the contract completely when purchasing a vehicle since returning it is not typically beneficial to the buyer. You will likely lose any down payments and monthly payments you already made.

However, in the event you simply cannot make the payments on a car loan, then returning it to the dealership, while not ideal, may be the best solution.

In most cases when a car is returned, the vehicle is reported as repossessed and the car buyer takes a hit to their credit score. In the event the car is returned in bad condition and the dealership is unable to resell the vehicle, the dealer or finance company may choose to sue for deficiency, in which they would be able to garnish wages if they win the case.

Due to the risks to the car buyer when returning a financed vehicle, it is important to do everything possible to keep the car and pay back the auto loan.

A trade-in can be a somewhat complicated process for a dealership, especially if the car is worth less than what is owed.

Essentially, there are two different processes for trading in a car. This is true for any car dealer, not just those that specialize in bad credit car finance. The first is when the car is worth more than the remaining payment amount, which is a good thing for the buyer. In this instance, the dealership will pay the remaining amount and possession of the car is given to them, allowing you to then purchase a new vehicle.

Things become more complicated in the event the car is not worth as much as what is owed, in which case the amount owed on the vehicle after trade-in is added onto the loan for the new car.

New car, low monthly payment, and low down payment; the holy trinity of purchasing a car for someone who has bad credit. In the real world, credit scores signify risk and, if it's low, the only ways to mitigate that risk for the lender are:

And the newer the car or the more valuable it is, typically the higher the down payment will be. This is why buy here pay here places sell vehicles that are a few years old or older - to lower the down payment and monthly payment obligations for their buyers.

Another option available, in order to reduce the cash required up-front when buying from bad credit car dealerships, is to trade in a vehicle as part of the down payment. This, in turn, lowers the amount financed and the monthly payment too.

Check out this handy car loan payment calculator that determines typical interest rates and monthly car payments based upon credit scores: